Helping you move forward with expert credit repair, proven credit-building tools, and real business funding. Here’s how we make it happen:

Credit Repair

Clean up your past. Rebuild your future.

Bad credit doesn’t have to hold you back. Our credit repair service targets inaccurate, outdated, or unverifiable items on your credit report. This includes:

Collections

Late payments

Charge-offs

Hard inquiries

Bankruptcy entries

Student loan discrepancies

Identity theft-related accounts

Credit Building

We don’t just fix your credit — we help you grow it.

Our credit building service is designed for people who are starting fresh or want to maximize their score potential. We’ll create a personalized plan based on your financial goals and current credit situation. Services include:

-

Secured credit card recommendations

-

Authorized user tradelines

-

Credit mix optimization

-

Utilization strategy coaching

-

Credit score tracking tools

-

Reporting rent and utility payments

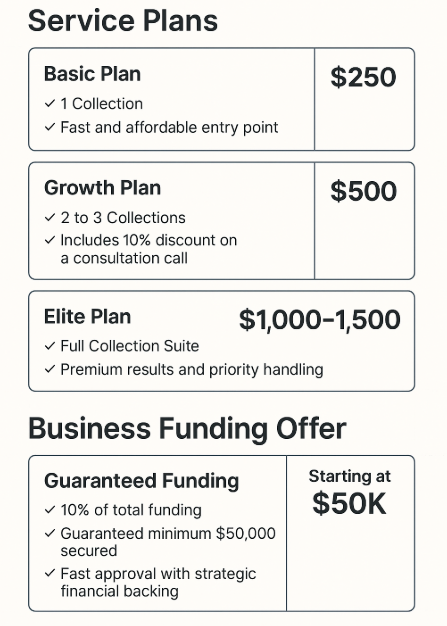

Business Funding

Get the capital you need — without getting stuck in endless rejections.

We specialize in helping entrepreneurs and small businesses access real funding — even if they’re just starting out or rebuilding credit. We assess your qualifications and match you with funding options such as:

0% interest business credit cards (intro period)

Unsecured lines of credit

Working capital loan

- Up to 50k Guaranteed in Funding

FAQ

How It Works?

Step 1: Book a Free Consultation

We start by reviewing your credit report and goals — no pressure, no commitment.

Step 2: Personalized Plan

You get a step-by-step action plan tailored to your credit situation and target outcomes.

Step 3: We Execute

We handle disputes, credit strategy, and lender matching — keeping you informed along the way.

Step 4: You Progress

Watch your score rise, unlock better opportunities, and regain control of your financial future.

Why Choose Motion Credit?

- 5+ years of experience in credit strategy

- Transparent pricing & no hidden fees

- Results-focused, not subscription-locked

- Real human support, no bots

- Nationwide service — 100% online

Can I still get results if I’ve already tried credit repair elsewhere?

Absolutely. Many of our clients come to us after other services failed them. Our process is more aggressive, more personalized, and focused on long-term gains — not just short-term fixes.

Do I need a certain credit score to qualify for business funding?

Not always. Some funding options require a 650+ score, while others are based on revenue or business age. We assess your profile and match you with the most realistic options — including 0% interest credit lines and low-doc lending.

Do you work with all three credit bureaus?

Yes. We submit disputes to all three major credit bureaus — Experian, Equifax, and TransUnion — and monitor responses to ensure results are reflected across the board.

Get 10 % off

Click the Button Below and Book a Consultation for a 10% discount on credit repairs!